Picture this: you're standing at a crossroads contemplating the question, should I buy a 1 bed or 2 bed flat? Choose the cozy 1 bed, or go all out for that spacious 2 bed flat. It's a decision that can shape your future, both in terms of comfort and financial investment.

As someone who has personally experienced the joys of living in a 1 bed flat for four wonderful years, I know the thrills and challenges that come with it.

But here's the twist: What if I told you there's more to this decision than meets the eye?

In this insight, I aim to aid your decision-making process when looking at buying flats. We consider personal considerations, considerations for investment purposes, and the national statistics that back up the arguments on which you should buy.

When deciding between a 1 bed or 2 bed flat, consider your budget, future plans, space requirements, and lifestyle preferences.

A 1 bed flat is more affordable starter home and requires less maintenance, but may have limited space and may be harder to sell.

A 2 bed flat offers room for growth and potential rental income, but can be more expensive.

When deciding between a 1 bed or 2 bed flat, it's important to consider various factors that can influence your decision. Here are some key points to keep in mind:

One of the most significant factors is your budget. Generally, 1 bed flats are more affordable than 2 bed flats, both in terms of the purchase price and ongoing expenses. If you have a limited budget or are a first-time buyer, a 1 bed flat may be a more realistic option for you, especially if you need a mortgage.

Consider your current and future space needs. If you're single or a couple without immediate plans for a family, a 1 bed flat may provide enough space. However, if you anticipate your family growing or need a home office, a 2 bed flat offers more flexibility and room for expansion.

Your lifestyle and personal preferences should also play a role in your decision. A 1 bed flat can be an excellent choice for individuals or couples who value simplicity and ease of maintenance. It requires less cleaning and upkeep, allowing you to focus on other aspects of your life.

While a 2 bed flat offers more room for flexibility and can comfortably accommodate guests or family members who may visit, it's worth noting that even in a 1 bed flat, it is possible to host guests.

In fact, I have personally managed to host guests in my own 1 bed flat by using smart furniture solutions, such as a pull-out sofa bed. This allows me to provide an extra sleeping space when needed without needing a 2 bed.

Although it's not ideal, we make it work for a few days a year. Even if you opt for a 1 bed flat, rest assured that there are practical ways to accommodate guests effectively.

If you're considering purchasing a flat as an investment property, it's important to think about the rental potential and investment value.

In certain areas, 1 bed flats may be in high demand, especially in city centres where young professionals and students seek affordable housing options.

However, 2 bed flats have their advantages too. They can attract a wider range of tenants, including small families and professionals looking for extra space. Additionally, 2 bed flats tend to appreciate in value more quickly compared to 1 bed flats, making them a potentially more lucrative long-term investment.

Ultimately, it's important to assess your financial situation, future plans, and personal preferences before making a decision on the number of bedrooms in your flat.

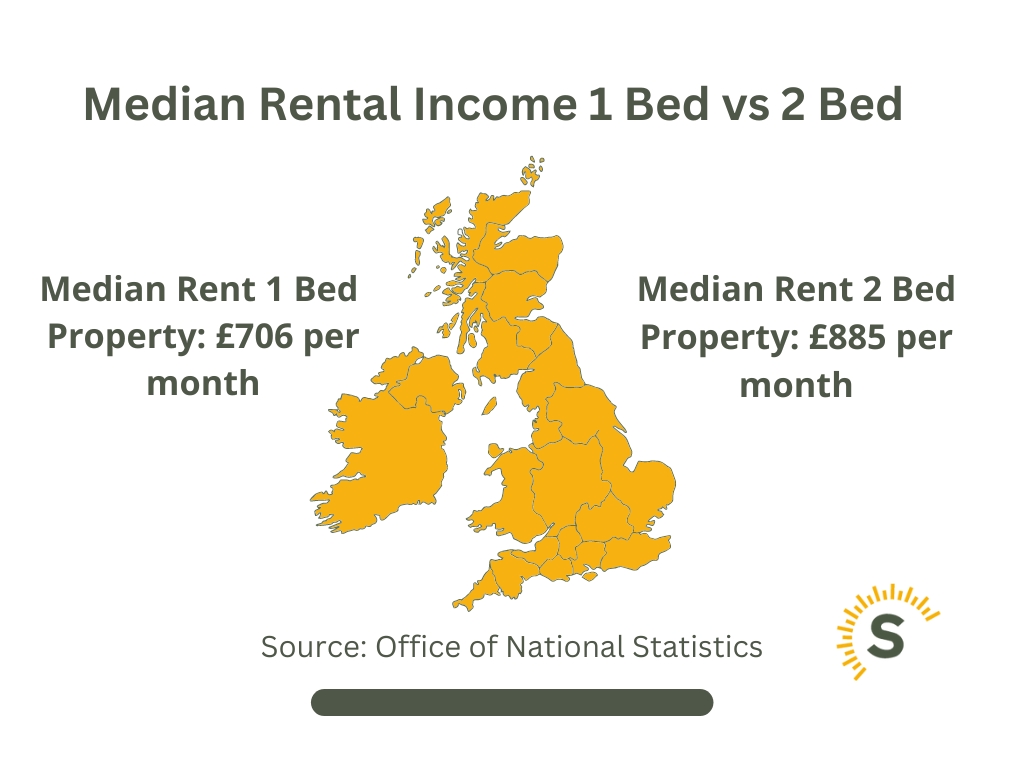

According to the Office of National Statistics, a 2 bedroom property achieves a median £174 extra per month in rent than a 1 bed property. From an investment point of view, consider the difference in property prices and the impact the additional income would have on the property yield.

Based on the stats, I wouldn't say it is always worth it the extra room as the income difference doesn't seem enough.

However, it does depend on much more than the national median. For example, some properties will have unique features that fetch a high rental income for a cheaper purchase price, such as a large outdoor space in a city. If you can find the diamond in the rough, you can really find a gem of a Buy to Let.

Advantages of One Bedroom Flats |

|

|---|---|

| Low Maintenance | With less space to look after, one-bedroom flats are less demanding in terms of maintenance. |

| Cost-effective | These flats are generally cheaper, making them an easier route onto the property ladder and have less monthly running costs. |

| Ideal for Single Occupancy | The smaller space is perfect for single person living, and it attracts less council tax. |

| Attractive to Certain Buyers | A one-bedroom flat in a desirable location can be easier to sell to property investors, Airbnb hosts, and first-time buyers. |

Disadvantages of One Bedroom Flats |

|

| Limited Ownership | With a leasehold property, you own the lease, not the property itself. |

| Limited Space | You can outgrow the space very quickly, especially if you have a partner or are planning to start a family. |

| Selling Might Be Challenging | One-bedroom flats can be harder to sell than two-bedroom flats due to their limited space. |

| Ground Rent and Service Charges | In some cases the costs of ground rent are the same, whether you own a one-bedroom or two-bedroom flat. |

Advantages of Two Bedroom Flats |

|

| More Room | A two-bedroom flat offers more space, allowing for personal growth or the possibility of starting a family without having to move. |

| Potential Extra Income | The additional room can be rented out for extra income. |

| Ease of Maintenance | Like one-bedroom flats, these properties are generally easier to maintain than houses. |

| Easier to Sell | A two-bedroom flat is often more desirable to property investors and other buyers, making it easier to sell. |

Disadvantages of Two Bedroom Flats |

|

| Limited Ownership | As with one-bedroom flats, you own the lease, not the actual property. |

| Potentially More Expensive | Some two-bedroom flats can cost more than houses. Plus, you'll have to pay service charges and potentially high levels of ground rent. |

| Higher Council Tax | The council tax charge is higher for a two-bedroom property. |

Determining whether a 1 bed flat is a good or bad investment is influenced by several factors, including market conditions, location, and individual circumstances.

Firstly, it is important to assess the market demand for 1 bed flats in the specific location.

Areas with high demand from young professionals or students seeking affordable housing options can make 1 bed flats a potentially lucrative investment.

Another aspect to consider is the rental income potential of a 1 bed flat. Conduct thorough research on the local rental market and rental prices to ensure that the potential rental income aligns with your investment goals.

However, when it comes to selling the property, despite it potentially being more affordable, a 1 bed flat will be suitable for less people. That could harm the potential for growth in value.

so, should i buy a 1 bed or 2 bed flat? There is no definitive answer as to whether a one-bedroom or two-bedroom flat is a better choice for you, as there are pros and cons to both. Ultimately, the decision between a 1 bed and 2 bed flat depends on your priorities and needs. Consider your budget, future plans, space requirements, and lifestyle preferences. Assess the potential rental income and investment value, as well as the market trends and demand in your desired location.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£51,000+

£51,000+  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Derry / Londonderry, County Derry / Londonderry

Derry / Londonderry, County Derry / Londonderry Free Consultations

Free Consultations

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.